net investment income tax 2021 calculator

Taxes Made Simple Again. April 28 2021 The 38 Net Investment Income Tax.

What You Need To Know About Capital Gains Tax

Taxes Are Complicated Enough.

. For more information on the Net Investment Income Tax refer to Tax filing FAQ. If an individual has income from investments the individual may be subject to net investment income tax. The NIIT applies at a rate of 38 to certain net investment income of individuals estates and.

However you also have 75000 in net investment income from capital gains rental income and dividends which pushes your total income to 275000. Ad Use one of the 10 Online Tax Calculators. Given the complexity of the 38 tax if this tax is applicable for you based on the guidelines above we.

Taxpayers with taxable income of between 80000. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable.

Ad Use Our Free Powerful Software to Estimate Your Taxes. Youll owe the 38 tax. The Net Investment Income Tax is imposed by section 1411 of the Internal Revenue Code.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 1 2013 individual taxpayers are liable for a 38 percent Net. For a child who must file a tax return Form 8615 Tax for Certain Children Who Have Unearned Income is used to calculate the childs tax and must be attached to the childs.

For estates and trusts the 2021 threshold is. Because your income is now 25000. Preparing Them Shouldnt Be.

This is the detailed computation of the Net Investment Income Tax which is regulated by section 1411 of the Internal Revenue CodeWe earlier published easy NIIT. Your net investment income is less than your MAGI overage. Jul 18 2021 If taxable income is less than 80000 for the tax year you wont pay capital gains taxes.

The formula for calculating tax percentage is total tax payable divided by the total net taxable income for the financial year. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined.

Not Only Get Your Refund But Many Other Answers. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. For example- for the financial year 2021-22 the net taxable.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

How To Calculate The Net Investment Income Properly

Net Investment Income Tax What It Is And Why It Might Disappear Soon The Motley Fool

Capital Gains Tax What Is It When Do You Pay It

How To Calculate Your Profit In 2021 When Selling Your Rental Property Mortgage Blog

How To Calculate The Net Investment Income Properly

2021 Estate Income Tax Calculator Rates

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Tax Calculator Estimate Your Income Tax For 2021 And 2022 Free

Tax Calculator Figure Your 2021 Irs Refund Before Filing Your Return

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

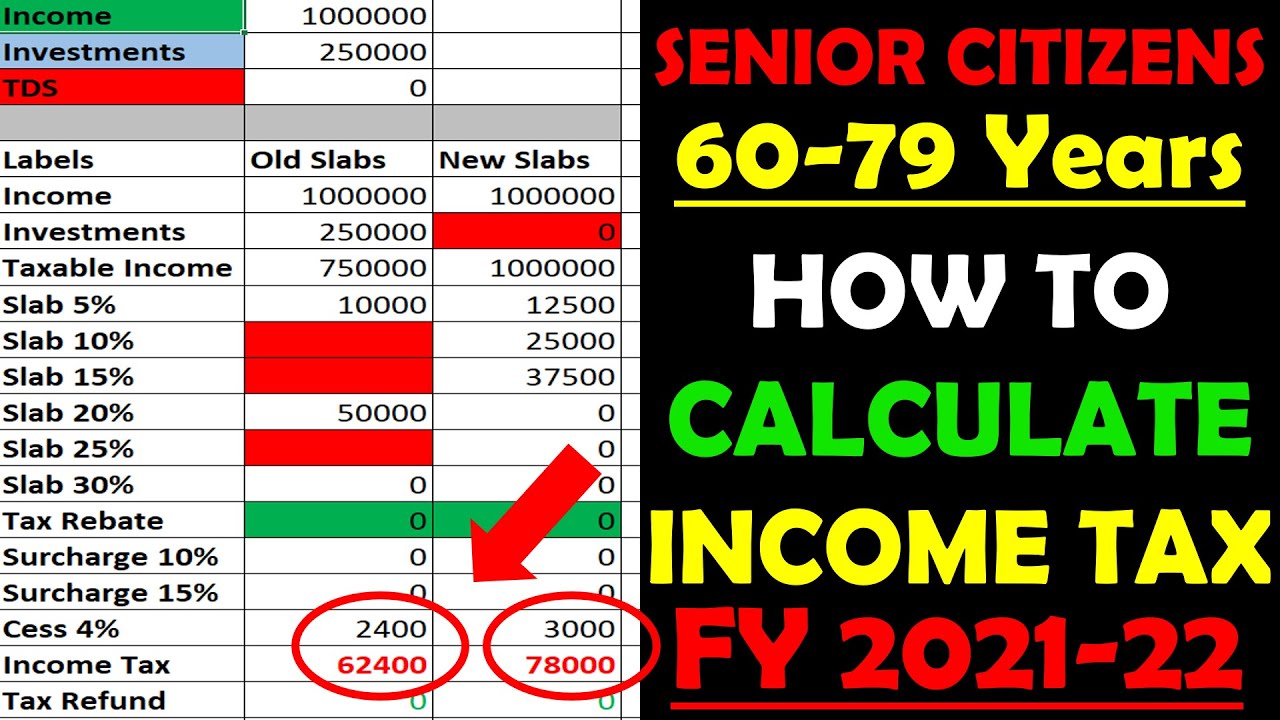

How To Calculate Income Tax Fy 2021 22 Excel Examples Senior Citizens Age 60 To 79 Years Youtube

What Is The The Net Investment Income Tax Niit Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Calculator 2022 Casaplorer

Tax Calculator Estimate Your Income Tax For 2021 And 2022 Free

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Calculate The Net Investment Income Properly

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube